|

(1)

|

(2)

|

(3)

|

|

Taxable

person

|

Taxable

service

|

Total

value of taxable service

|

|

8.

Any person, Government agency, local authority or statutory body who provides

advertising services.

|

Provisions

of all advertising services, excluding provision of such services for

promotion outside Malaysia.

|

RM

500,000

|

(Advertising services were also taxable services and taxable persons were similar but these were categorised under Second Schedule, Group G in Service Tax Regulations 1975)

It is important for businesses or persons providing services in such an industry to know if the nature of their services is considered 'Advertising services.'

Businesses need to consider whether tax has to be charged on the total cost of the services provided or on Commission received as well as who pays when the total of your services does not reach the threshold of RM500,000 per year but if combined with associated business which undertakes the job, the threshold is reached. A party may not be registered but a related party is registered, so how is tax to be calculated in such a situation.

Below are some decisions that will help business persons understand their position and tax liability.

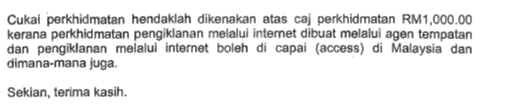

3. Local business or person who acts as an agent to recruit clients for Advertising through

Overseas principal and advertising is managed by Overseas principal

5. Printing cost where itemised in Bill is exempted:

7. Proses Kerja serta peranan pihak-pihak yang terbabit dalam perkhidmatan pengiklanan:

pengiklanan. Nisbah boleh berbeza kecuali ditetapkan oleh Persatuan

9. Work Process and role of players in Advertising services and Tax liability:

No comments:

Post a Comment