MENGENALI ROKOK YANG SAH DAN YANG

TIDAK SAH (Genuinely Imported/Locally manufactured with taxes paid vs

Contraband cigarettes)

. 1. Yang

dimaksudkan “Sah” atau “Tidak Sah” ialah sama ada diluluskan untuk dijual di

pasaran Malaysia. Rokok yang “Sah” adalah rokok sama ada diimport atau dikilang

tempatan yang telah berbayar duti import (jika diimport), duti eksais (untuk

rokok dikilang tempatan atau diimport) dan Cukai Barangan dan Perkhidmatan

(“GST”) (untuk rokok yang diimport atau dikilang tempatan)

2 2. Rokok

yang dikilang tempatan ertinya dikeluarkan oleh kilang Eksais dan rokok yang

diimport perlu mematuhi beberapa syarat sebelum dibenarkan untuk edaran di

pasaran tempatan. Syarat-syarat ini ditetapkan pada lesen Eksais yang

dikeluarkan oleh Jabatan Kastam atau dalam Perintah Kastam (Larangan Mengenai

Import) 2017.

3 3. Berikut

adalah syarat yang ditetapkan dalam Perintah Kastam (Larangan Mengenai Import)

2017:

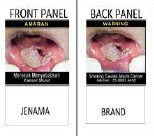

A. All importers shall comply with the health warning on

cigarette packaging:

(1) Packet of cigarette:

(a) On each packet of cigarette there shall be printed a health

warning consisting of any one of the following set texts and images:

(b) the set texts and images shall be printed with fifty

percent coverage area to be positioned from the top on the front panel and with sixty percent coverage area to be positioned from the

top on the back panel

(c) the images shall be printed with resolution not less than

300 dpi (“dpi” or “dot per inch” means the degree of resolution of printing

images expressed in terms of number of printed dots per linear inch)

(d) the set texts and images shall be printed using not less

than four colour printing

(e) the set texts shall be printed, in lettering of Arial of 10

points for each packet, in pure white on a

Matt Black background, except the

words “AMARAN and “WARNING” which shall be printed, in bold-faced

lettering of

Arial of 12 points for each packet, in yellow on a Matt Black background

HEALTH WARNING 1

HEALTH WARNING 2

HEALTH WARNING 3

HEALTH WARNING 4

HEALTH WARNING 5

HEALTH WARNING 6

HEALTH WARNING 7

HEALTH WARNING 8

HEALTH WARNING 9

HEALTH WARNING 10

HEALTH WARNING 11

HEALTH WARNING 12

HEALTH WARNING 3

HEALTH WARNING 4

HEALTH WARNING 5

HEALTH WARNING 6

HEALTH WARNING 7

HEALTH WARNING 8

HEALTH WARNING 9

HEALTH WARNING 10

HEALTH WARNING 11

HEALTH WARNING 12

4. Syarat-syarat yang sama ditetapkan untuk dipamerkan pada karton iaitu

bungkusan yang

mengandongi peket-peket rokok

(2) Carton of cigarette:

(a) on each carton of cigarette there shall be printed a health

warning consisting of any one of the following set texts and images:

(Imej-imej sama seperti di

atas)

B. Health information on cigarette packaging:

(1) Packet of cigarette:

(a) on each packet of cigarette there shall be printed the

following health information, sale restriction and particulars on its panel:

(b) Cartoon of cigarette:

(a) on each packet of cigarette there shall be printed the

following health information, sale restriction and particulars on its panel:

(b) the health information shall be printed in lettering of

Arial not less than 26 points for each packet.

C. Tax stamp:

(a) on each packet of cigarette there shall be affixed a tax

stamp as approved by the Director General.

(b) the tax stamp

shall not visually obstruct the health warning and health information

5 5. Syarat-syarat

seperti di atas telah ujud sejak 2008 iaitu seperti ditetapkan dalam Perintah

Kastam (Larangan Mengenai Import) 2008 yang telah berkuatkuasa pada 1 Apr 2008

sehingga digantikan dengan Perintah Kastam (Larangan Mengenai Import) 2012 pada

April 2013.

6. Perintah

Kastam (Larangan Mengenai Import) 2008 mempunyai syarat berbeza untuk kawalan

Rokok sama ada diimport atau dikilang tempatan iaitu:

That

there shall be clearly and conspicuously printed in a prominent position on

every container of cigarettes imported the following words:

(a) 'AMARAN OLEH KERAJAAN MALAYSIA-MEROKOK MEMBAHAYAKAN KESIHATAN'; and

(b) 'TIDAK MELEBIHI 20 MG TAR, 1.5 MG NIKOTINA'.

Where the container is a packet which is rectangular block in shape, the words shall be printed on either of the side panels of the packet. Every packet of cigarette must also be affixed with tax stamp approved by the Director General of Customs

(lihat Jadual ke-4 Bahagian II, item

1.)